About Chemical Distribution

The Chemical Distribution sector is of crucial importance for the European economy.

Fecc Members – many of which are family-owned enterprises – create value in the chemical supply chain by meeting the demands of over 1 million downstream users ranging from all branches of the Industry, with their specific needs and diverse purchase volumes.

Fecc represents around 1,600 companies with around 30,000 employees at more than 1,300 sites handling 22 million tonnes shipped with an industry turnover of approximatively €28 billion.

The chemical distribution business is a very diverse industry that covers different sectors and provide customized solutions. Sectors include: pharmaceuticals, construction, paints & coatings, agriculture, cosmetics, food & feed, automotive to mention some.

The activities that are part of the chemical distribution industry, include: packaging, logistics, warehousing, mixing, blending, formulating, technical support, training, recycling, research & development, innovation, ingredients.

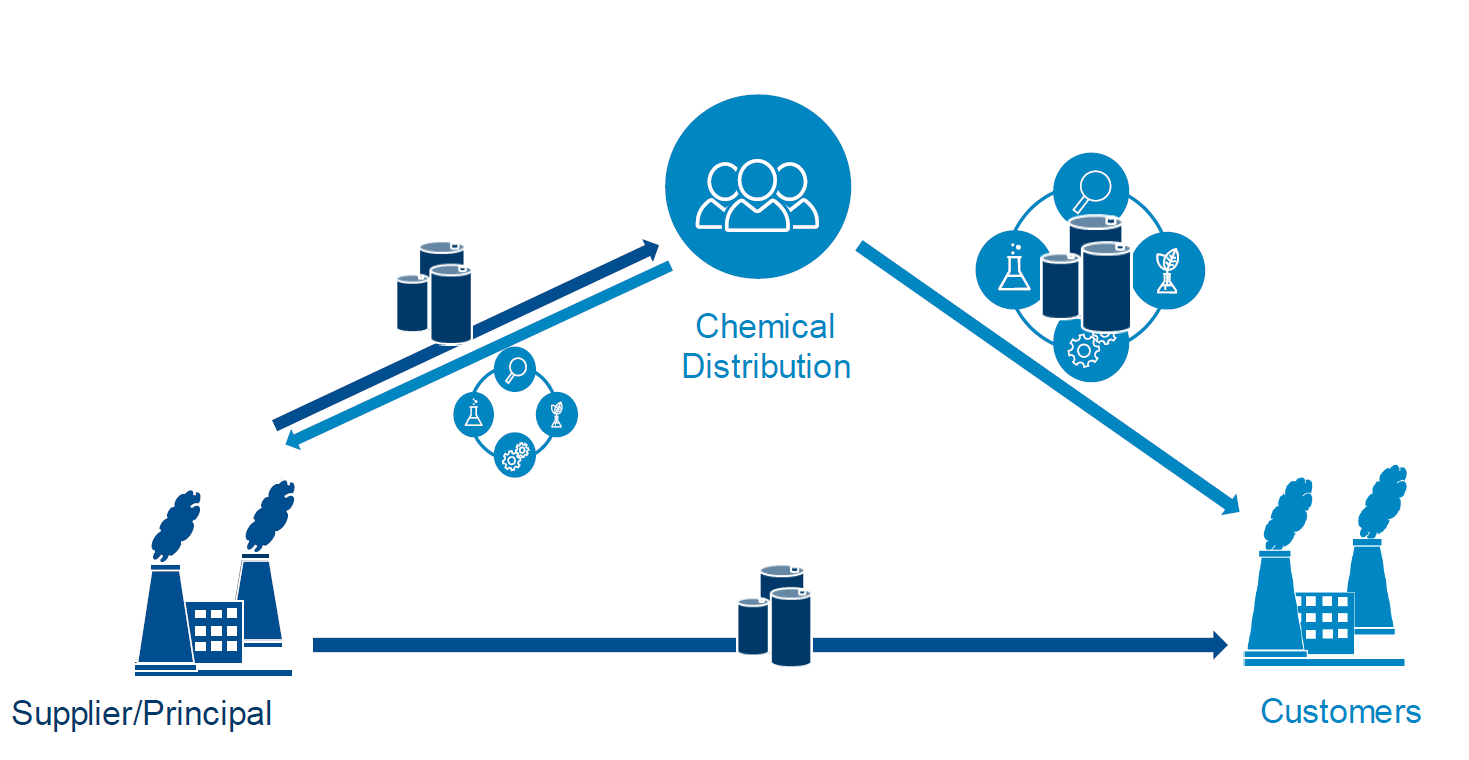

At the center of the supply chain, the distributors have to deal with four main key factors: geographical and time related distances, quality balancing, assortment of goods and service. One of the main objectives of the distributor is related to the supply management and how to be a real added value.

Distributors face many challenges to remain competitive, including: promptness of service and short delivery times. Different sectors, which means different areas of expertise in hazardous, pharma and food ingredients to respond to a vast majority of clients. And finally, distributors aim to provide services that are cost competitive through a centralized group management.

As the market needs are very precise, our industry needs to follow not only the current market trends but also be able to provide formulatory excellence, a vast product portfolio, a service-oriented experience and a ready to use solution.

The chemical distribution sector: key data 2023

The New Age of Winning (White paper)

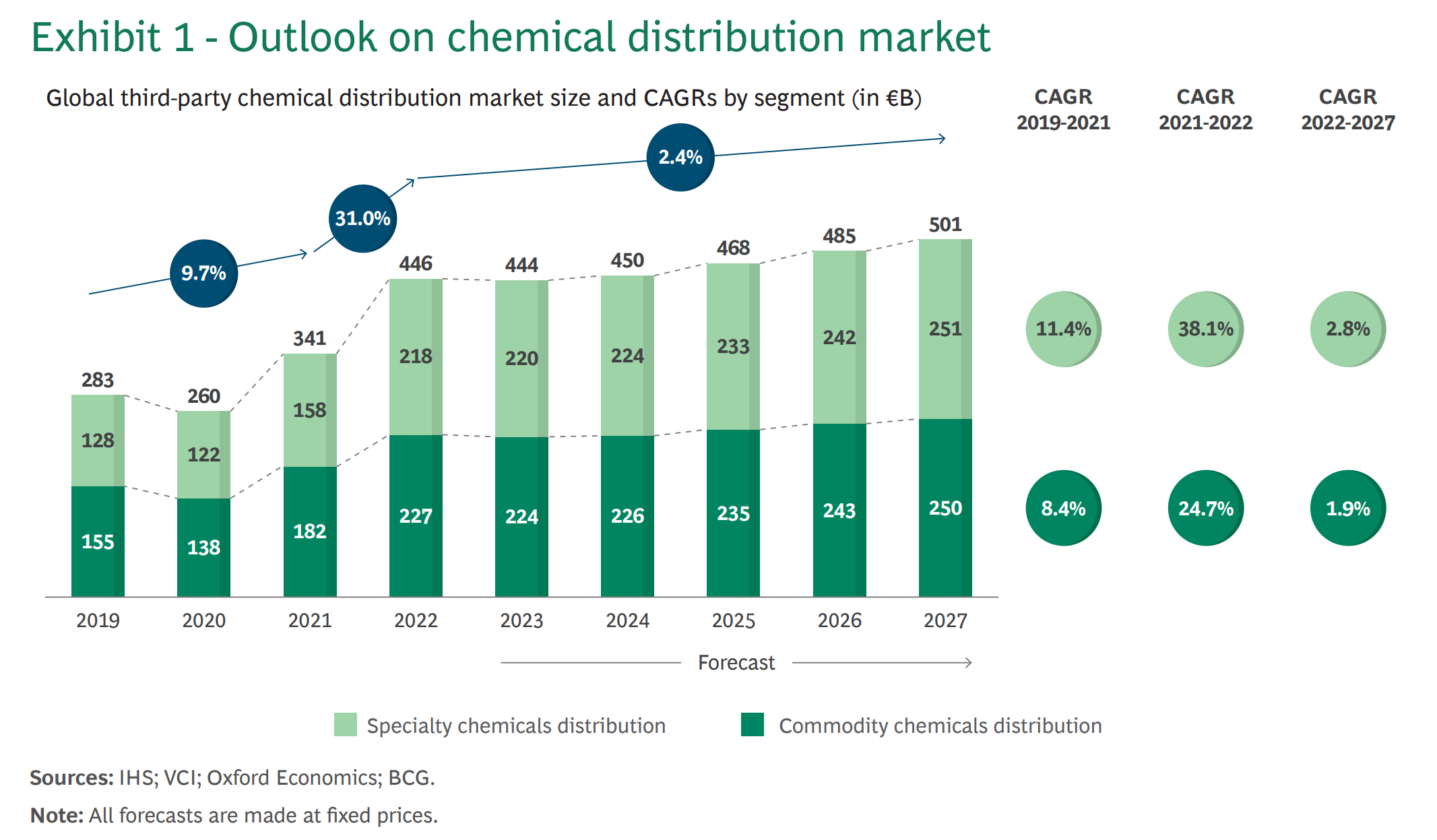

This 2023 chemical distribution paper shows recent trends and evolving principals’ expecta-

tions. It reveals a notable rise in third-party distributor usage across regions and

chemical sectors. Principals require diversity in distributors and maintain the upward trend

from previous years. They now demand higher distributor standards while being less tolerant

of performance issues. The paper also examines China’s special market dynamics. These

findings emphasize the need for adaptable chemical distributors. By enhancing offerings,

ensuring performance, managing costs, and embracing sustainability, distributors prove as

essential partners for long-term success amidst evolving challenges.

More on the BCG’s White Paper.

Source: Boston Consulting Group (BCG) analysis, September 2023.

The chemical distribution sector: key data

How Digitalization Affect Chemical Distribution?

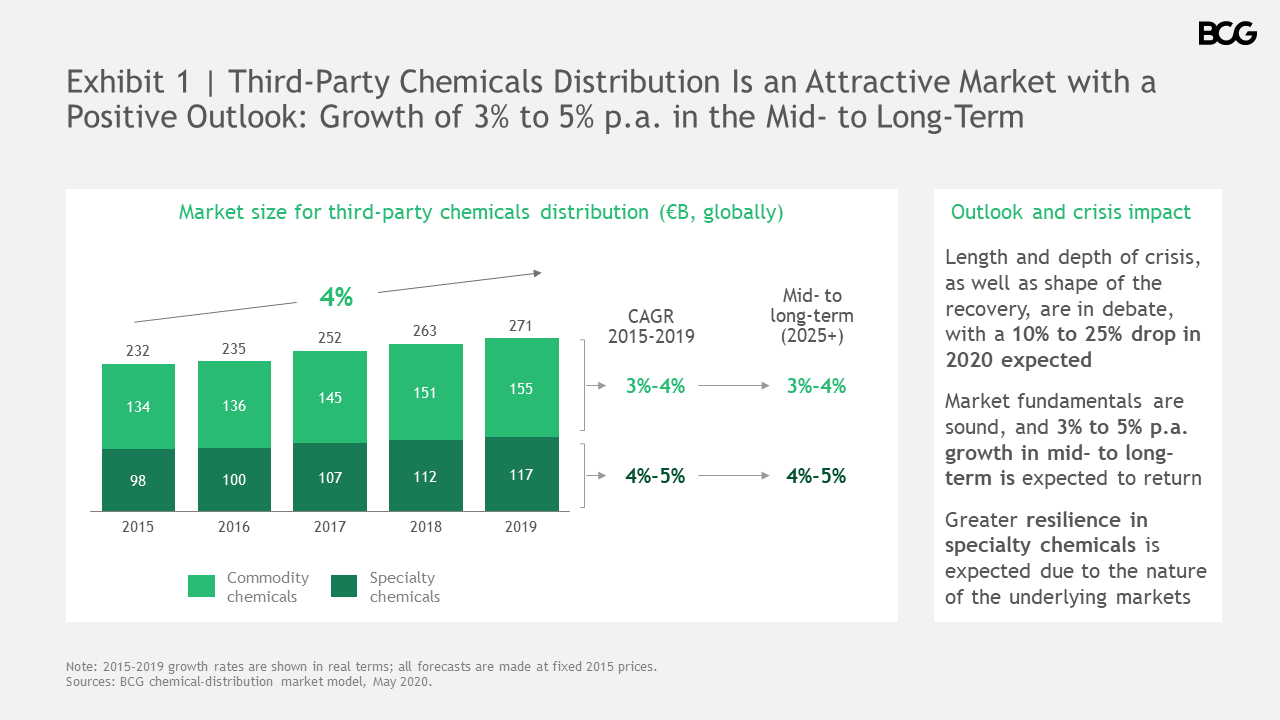

Will digitization enhance the chemical distribution sector—or make it obsolete?

While incumbent distributors are moving slowly to digitize their internal operations and their external customer and supplier interactions, market leaders aren’t waiting. They’re investing significantly in digitization. And new entrants, such as Xenon arc, are playing the digital card, presenting new channel options to both suppliers and their end customers.

As digitization becomes a reality, therefore, many wonder about the outcome. Will suppliers and end customers use the advantages of digitization to interact with each other directly, cutting out the middleman? Or will digitization simply strengthen existing business models, boosting transparency and cutting costs?

More on the BCG’s abstract.

Source: Boston Consulting Group (BCG) analysis, June 2020.

The chemical distribution sector: key data

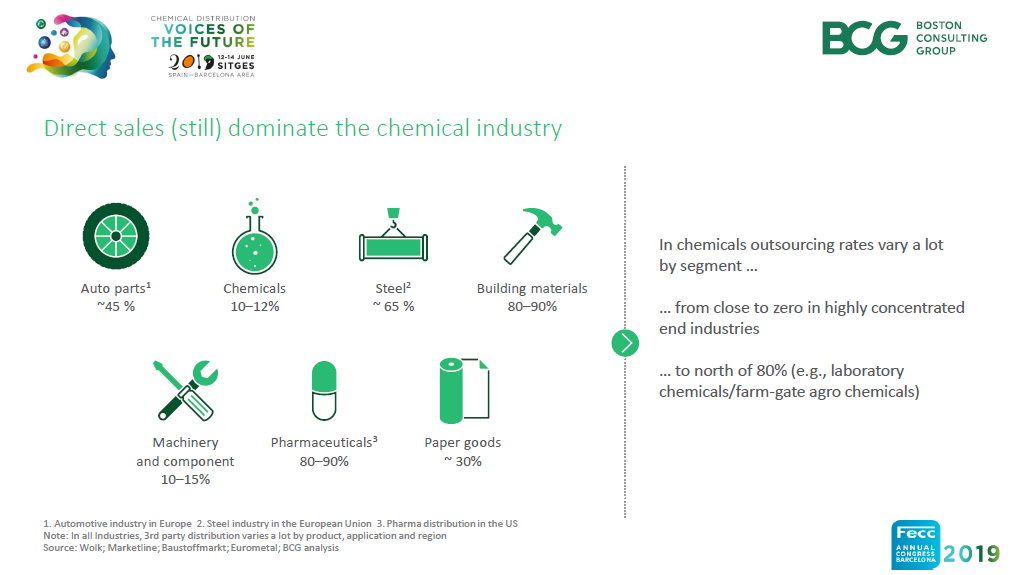

Presented during the Fecc Annual Congress in Sitges (June 2019), the study by Boston Consulting Group (BCG) gives an overview of the current status of the chemical distribution sector with key data.

The study focuses on market development drive and market trends with implications for chemical distributors and different areas, including sustainability, security and safety.

To access the full presentation, please click here.

Source: BCG analysis (2019).

About distribution

Credit: IMCD Germany

About distribution

Logistics & Packaging

One of the key roles of the European chemical distribution sector is to bring flexibility to clients when it comes to volumes and packaging. We ensure that our clients can get what they need, in whatever quantity they need, and whenever they need it.

Formulating

Chemical distributors help clients develop bespoke formulations that fit their specific needs. Our reach, scale and client proximity allow us to develop tailored solutions, even in smaller quantities.

Recycling

We help our clients recycle both packaging and products in a safe and efficient manner. Our hubs ensure that products and all kinds of packaging materials are collected and transported safely to be recycled.

Research & Development

The European chemical distribution sector goes beyond simple distribution. We are a driver of chemical innovation supporting clients by developing new, tailor-made products with unique properties.

Training

Every year, we help trains thousands of people in the safe handling and responsible use of chemical products. This training drive efficiency and ensure that we comply with the most ambitious HSE standards.

Warehousing

Chemical distributors store chemicals safely and in optimal conditions for their clients. They help manage inventories effectively and efficiently and contribute to optimising supply chain processes.